Buy a Business

Most buyers are interested in purchasing a business for many reasons. Here are a few reasons:

- Job Security.

- Financial Independence.

- Personal Growth.

- Personal Gratification.

- Control your own Destiny.

- Pride of Ownership.

- Creative Freedom.

By working with VR, you have the advantage of dealing with the largest and most experienced business brokerage organization in the world.

We can introduce you to more good business opportunities than our competitors.

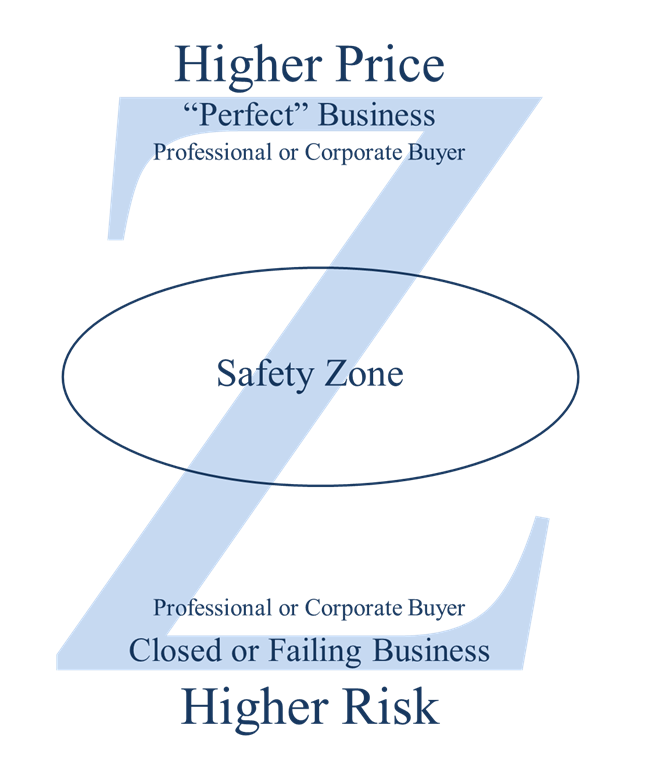

Some buyers look for the “perfect” business (high profits, low risk, great potential, easy to run, no problems, etc). If they can ever find a business like that, the price will be very high and they will be competing with well-financed industry professionals and corporate buyers to purchase the business.

Other buyers look for very cheap businesses, often closed down or failing. These businesses are very risky and may involve significate additional investment to make them profitable. They are usually best left to industry professionals or corporate buyers who can afford the cost and the risk.

Most of the business VR sells are in the “safety zone” on the diagram, you see here. These businesses are priced lower than the “perfect” business (if it really exists) but are less risky than the closed or failing business. The key is to look for a business that is established but has some problems you can solve. That way the business will be affordable and you can take all profit from the improvements you make.

2. Non-Disclosure Agreement (NDA): You sign a Non-Disclosure Agreement thereby promising to maintain confidentiality for all the information provided to you on the businesses we review, discuss or present.

3. Buyer Profile: By completing the Buyer Profile, you are providing us with the information about yourself such as a resume, financial statement and available capital to invest. The more we know about you, the more likely it is we can find a business for which you are qualified to acquire. The more information we provide to the seller and financing sources, the stronger your negotiating position.

4. Opportunity Review: Together we discuss and review various types of industries and specific businesses, and select some that appeal to you and which are qualified to acquire. You will have the ability to review confidential business profiles that, in part, summarize the business, its’ financial information, facility and lease information.

5. Business Presentation: We present to you the businesses you are interested in and discuss the opportunity surrounding each. These initial presentations can vary from digital presentations in our boardrooms to actual on-site visits as the information process moves forward. It is critical to remember when visiting any business, that the fact it is for sale is highly confidential and you must be careful to maintain this confidentiality during the visit.

6. Meeting with the Seller: A meeting between you, the seller and VR may take place if you are interested in obtaining more information regarding the business, and seriously consider it as a candidate for acquisition. This gives you the chance to ask questions you may have about how the business operates and allow the seller to feel comfortable in who is acquiring their business.

7. Offer to Purchase: With the assistance of VR, the next step is to prepare an Offer to Purchase on your standard Purchase Agreement for the business. A Letter of Intent may be used on larger valued transactions. An Offer to Purchase or Letter of Intent will include an earnest money check along with contingencies that are to be satisfied during Due Diligence.

8. Present Offer: VR presents your offer to the seller and takes the time necessary to explain the terms and conditions of your offer to the seller and their decision makers.

9. Background: With your approval, VR provides to the seller your background, financial information, experience and point of view in arriving at the offering price, and terms and conditions. Favorable background information about you will result in favorable consideration to your offer.

10. Acceptance or Counter Offer: The seller will either accept the Offer to Purchase as it is written or will present a counter offer. Once buyer and seller agree to all terms and conditions of the sale, sign all counter offers and amendments, if necessary, you have mutual acceptance and it then becomes contingent Purchase Agreement.

11. Due Diligence and Inspection: At this stage the examination of financial records and other operational, inventory, management and lease reviews take place. The due diligence and inspection stages are critical for the buyer to confirm that what the seller has claimed to be truthful and accurate, and meets the conditions of your offer.

12. Contingency Removal: You remove all contingencies as each is resolved or met in the Agreement. Once completed, it is a binding agreement.

13. Escrow: Your VR Intermediary will send the Purchase Agreement and other documents to the escrow documents and deposits the earnest money deposit check into their trust account. Escrow is “open” as soon as both buyer and seller have signed the escrow documents. Depending on the state in which you live or are acquiring the business, this process may be handled by parties other than an escrow company. VR can inform you – in detail – what to expect in your market.

14. Lien Search: In most states, the attorney for the buyer or the escrow company performs a lien search on the business to identify any secured creditors. Liens to secured creditors will be removed prior to closing. During the lien search, there will also be an investigation with state and federal agencies for tax clearances.

15. Business License: During the escrow period the buyer, with their aid of their advisors, will be obtaining liability insurance for the business, workers’ compensation insurance (if required), all necessary business licenses, employer identification numbers and form the appropriate business entity.

16. Lease Assignments: The seller’s landlord may require the assignment of the existing lease or an entirely new one. You will, with the seller and the landlord, obtain the necessary documentation for closing. This is another critical step and one of your remaining contingencies. It is important to provide the landlord with a complete personal financial statement, resume and lease application promptly.

17. Note and Equipment Lease: VR will work with you, the seller, and an escrow officer to have an agreed upon notes and equipment leases assigned to you or your new corporate entity.

18. Inventory: Arrangements are made for you and the seller to count and price the inventory if it applies to the business you’re acquiring. If it is a large or complex inventory it may be necessary to outsource this function to an inventory service.

19. Training: Agreed upon training with the seller commences after the closing and during the change of position. The terms and length of the seller involvement training is agreed to as part of the executed Purchase Agreement.

20. Closing: Signing of the final closing documents may be done at escrow in person or, in many cases, via courier, e-mail or fax. These arrangements will be agreed upon by all parties prior to closing.

Note: Both the NDA and Buyer Profile are required before we disclose confidential information regarding a business.

Are you ready to learn more?

VR Business Brokers offers a transaction road map that is not only detailed, but proven